|

Oracle Pedia

Friday 19 April 2024

Join Our Webinar: Master Data Security Now!

Wednesday 17 April 2024

S&P Stock Market Trend Forecast to Dec 2024

S&P Stock Market Trend Forecast to Dec 2024 Dear Reader Here is the final installment of my epic analysis that concludes in detailed S&P 500 trend forecast for 2024 that was first been made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your last chance to lock it in now at $5 as it will imminently rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat. S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024 CONTENTS Formulating a Stock Market Trend Forecast The stocks bull market is raging whilst some $5 trillion is sat in cash watching from the sidelines, the only question mark is how high will stocks fly during 2024 as I doubt we will see a reply of 2023 +24% advance. Maybe end the year between +10% and +15% to between 5250 and 5485. Having scoured this analysis several times for what sticks out the most in terms of weighting of my concluding forecast - 1. Valuations are not overly extended and earnings growth for the S&P of 10% is probable which suggests the index should be able to add at least 10% so suggests a base case of 5250 2. The recession is always brewing, and likely will remain always brewing for the whole of 2024, which is good fro the bull market as the scared money will remain scared as they watch the likes of the cartoon network. The reality is that they are blind to the fact that the recession already happened in the first half of 2022! 3. Bond markets have done their worst and look like they have bottomed, which means yields will continue to fall. 4. Seasonal analysis and the Presidential election cycle analysis are once more painting a compelling picture for another bullish year for the stock market. Election years do tend to be bullish years. The resulting patterns of price action are very robust and thus form the core of formulating the trend forecast, pointing to peaks in Jan, Apr and August. Whilst troughs in March, June and October. 5. Best Time to invest cycle suggests to focus on a top between June and August to then capitalise on the correction into October. 6. We have the Exponential AI mega-trend that continues to EXPLODE delivering waves of productivity boosts to not just the tech giants but the whole economy, thus the economy and earnings should surprise to the upside i.e. underlying economic growth is ACCELERATING! Which is why economic theories that so many econofools cling onto are failing to work, always caught short, no recession! 7. Headline CPLIE Inflation is calming and so should market uncertainty, that and falling market rates will prompt the Fed to start lowering rates possibly as early as at the March 2024 meeting as the Fed FOLLOWS the bond market. 8. There is no FOMO, $5 trillion is parked in money market accounts, probably most of it is the institutional herd. 9. The USD is expected to continue to be weak, though not to the extent of 2023, thus supportive of a bull run of lesser extent than 2023. 11. Technical's remain bullish, whilst identifying resistance at 5,000 and then 5200 on eventual break of which to target the FOMO driven rush to 5400 by year end. 12. Sentiment lacks FOMO, so does not suggest a juncture (Top) is likely during 2024. 13. Expectations are for 3 discounting events during 2024 in March, June and October. 14. The underlying exponential INFLATION mega-trend continues, remember stock prices going up is INFLATION, House prices going up is INFLATION! ASSET PRICE INFLATION. 15. Election year uncertainty will likely hold stocks back until after the results are in followed by a strong relief rally into the end of the year. 16. We are in a BULL MARKET! In bull markets stock prices trend HIGHER so the only question mark is how high will stocks fly during 2024. There is a lot of money waiting to buy on a drop which means corrections are unlikely to be large. 17. We are not going to see a repeat of the +24% of 2023, at best around half that so about 12%. S&P Stock Market Trend Forecast Jan to Dec 2024 Therefore my forecast conclusion is that the bull market that began in October 2022 will continue for another year that targets a gain of 12.7% on the last close of 4770 to end 2024 at 5376, up over 600 S&P points. With the trend pattern playing out as illustrated by my forecast chart that allows for 3 interim tops followed by 3 corrective troughs before a strong post election rally into the end of the year for the bulk of 2024's gains, so choppy 10 months followed by 2 strong months.

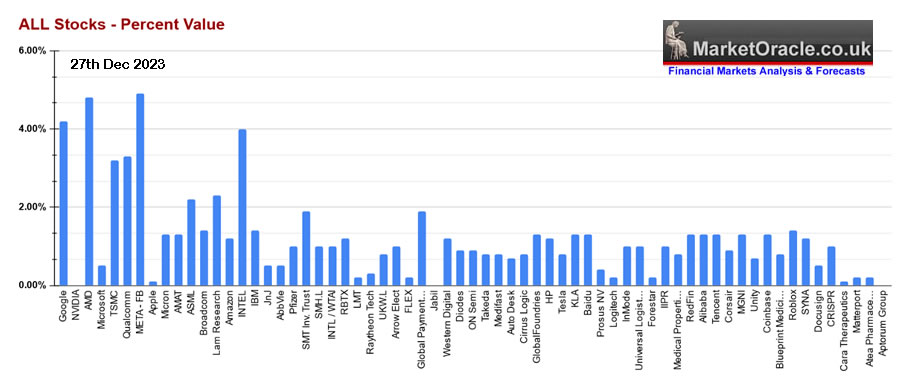

The bottom line is be grateful for the bull market of 2023, 2024, 2025,.2026 and probably 2027 because whilst you may now wish for stock prices to fall, even for a bear market so that you can buy with the benefit of hindsight, however if it happens fear will reign supreme which is why most would buy nothing. Instead what we have is year 2 of a bull market that will likely run for many more years as that is what tends to follow bear markets, multi-year bull markets. So it is better to DCA into a BULL market to gain exposure then hope to buy corrections which as I often state are a case of getting lucky as the risks are to the upside. Quantum AI Tech Stocks Portfolio Whilst the S&P road map will be useful however the meat and potatoes of returns will come from my Quantum AI tech stocks portfolio., that lists the target stocks in order of supremacy where the name of the game is to gain and maintain exposure which is harder said then done as evidenced by the fact that despite Nvidia being No2 on my list hold barely 1% of target, whilst others such as Intel I am over invested tot he tune of 125% of target. Where one needs to learn to be grateful for what the stock market givers and not get greedy or chase FOMO at times of over salutation. The current state of portfolio is 87.6% invested, breakdown is AI 48.4%, Medium Risk 22.5%, High Risk 12.6%, Crypto's 4.1%, Cash 12.4%. Cash is the oil that allows your portfolio's engine to run smoothly, without cash the engine will seize so don't make the mistake of not carrying adequate cash on accounts to allow one to capitalise on opportunities, I see some folk making the mistake of getting convinced into putting their cash into money market ETF's when instead most of ones cash should be committed to limit orders as GPN illustrates the stock soared to $138 and then dumped to $121 last Thursday, I had a large SELL limit executed at $136 and small buys at $124-$123. Current price is $128, the buys would not have happened without cash on account and 2023 is littered with many similar examples such as AMD's dump during early May to $80. So don't make the mistake of chasing peanuts (money market ETF's) instead focus on capturing the opportunities (AMD $84-$80 dump, current $139).

Today's AI mantra in the MSM will in the not too distant future become a Quantum AI mantra. Whilst AI will reveal soon that humans are not as intelligent as we think we are, for instance we cannot even see the nights sky as it truly is only having evolved to see a tiny fragment of the electromagnetic spectrum, instead of a black void we would see a universe that literally glows in all directions due to being full of hydrogen gas. Unlike in the movies we don't stand a chance against AI! https://docs.google.com/spreadsheets/d/10fM9Sk9syxj1r3UqMmei9zZSdfPMon4l63LjVMI0T7k/edit?usp=sharing Primary AI Stocks

Google is Numero Uno Despite continuous noise from the MSM who repeat the mantra that Chat GPT has all but finished Google, nevertheless in my portfolio Google remains numero uno. which is a warning to all those who make the mistake of betting against Google as all those who listened to the cartoon network (CNBC) will painfully have experienced during 2023 as many likely sold out of Google during March 2023 at sub $90! Google is No1 for a reason in that Google is the Alpha and Omega of AI! It WILL SURPRISE to the UPSIDE just as it did during 2023 left most sat on the sidelines now hoping for a plunge so they can buy, but whenever it has fallen the same weak hands who sold for peanuts find a gazzilion reasons why they should now NOT BUY Google when it is cheap! 2. Nvidia - A bronco billy of a stock, very difficult to ride the Nvidia gravy train, all one needs to do is to invest and forget which is easier said then done given how extremely volatile the stock price is. Right now Nvidia is fair value. not, cheap not expensive, just fair.. 3. Microsoft $371 - Despite Chat GPT delivering Microsoft a shot in the AI arm the stock remains on the expensive side, which means it should continue to underperform the others whilst delivering no significant opps to accumulate during 2023. TSMC $102.5 - Has negative EGF's which means its going to find it tough to climb higher until these turn positive so I expect TSM to continue to under perform. Qualcom $143 - Cheap - Finally coming alive, I've been banging the drum that Qualcom is dirt cheap all year so folks have had plenty of time to accumulate at under $110, the break higher was only a matter of time, probably destined for new all time highs, next resistance is at $152, then $171 before the $192 All time high. AMD, META - Have okay valuations relative to EGFS / PE's AI - Secondary Stocks

Apple $197.5 - EGF's have turned strongly positive, so whilst not cheap it does look set to keep climbing higher. I would not buy it at X32.3 earnings! Maybe at around X25. Micron $82 - Is an anomaly, All it's metrics are very bad but it keeps climbing higher on AI FOMO mania, the lack of good fundamentals means it could be prone to a swift stock price collapse, but we just don't know, I am good either way, if it drops I'll buy some more if it FOMO's I'll trim. I remain skeptical of Micron so will lighten my exposure from 67% invested if I see something like $95. AMAT $162 and ASML $753 have weak fundamentals, I'll buy a significant dip in AMAT whilst continue to trim ASML as it trades higher. Broadcom $1130 - To the MOON! Good fundamentals but the stock has run away with itself, now trading at 130% of it's PE range so it is expensive, I don't hold enough to trim so it's a case of just holding. LRCX $773 - Another one that's got weak fundamentals and is expensive hence I have been trimming somewhat. Amazon - $150 Metrics are all over the place, I'm comfortable with 56% exposure whatever the outcome. Overall Secondary are in a much weaker fundamental state then the primaries right now, which suggests that 2024 will be another year for MSM to obsess over Mag 7 out performance.

I think I will soon promote Tesla to a Secondary AI stock status, and I can eventually see it joining the primaries. I am currently 45% invested and will seek to DCA to at least 55% invested, given the AI trend trajectory this stock is on. Do read my investing guide which is part of the spreadsheet that will add rocket fuel to your portfolios performance via mechanisms such as trimming, scaling in and out that acts to drive down the average price paid per stock towards ZERO, though I only calc the effect for trimming manually for large trades due to volume of activity as no platform allows for the effect of trimming as the platforms base their calc's on the number of shares rather than the impact of trimming at a much higher price then where one bought the stock which in reality drives down the average price per share paid for the position that gives one a truer sense of actual exposure of hard cash to a stock. For instance AMD is 4.8% of my portfolio vs Google at 4.2% despite the fact that a lot more hard cash has been invested in Google than AMD. Similar for Broadcom, 1.4% of my portfolio but very little hard cash invested (16% of target). It's a pity that the platforms don't calc for this. The bottom line is when a AI primary or secondary stock experiences a severe correction that is NOT the time to second guess, panic and be paralysed by fear, that is a time to rejoice in being handed willie Wonka golden ticket to future riches, were all one ever needs to do is to buy the deviation from the high and then let earnings growth and inflation do their magic over time to once more resolve to new all time highs.. Your analyst putting his neck on the chopping block for another year. And again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your last chance to lock it in now at $5 before it soon rises to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat. My next in-depth analysis follows in just a few days time. Latest analysis - Stock Market, Interest Rates, Crypto's and the Inflation Red Pill Crackup boom + US Dollar black hole that some call the US Dollar Milkshake = Everyone on the planet is buying US assets! After all the US is the worlds sole Empire,

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series. Change the Way You THINK! How to Really Get RICH - Part 1 Part 2 was HUGE! > Learn to Use the FORCE! How to Really Get Rich Part 2 of 3 Part 3 Is Huger! And Gets the Job Done! >

Here's what you get access to for just $5 per month - ※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox. ※A concise to the point Investing Guide that explains my key strategies and rules ※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings. ※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook. ※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact. ※Join our community where I reply to comments and engage with patrons in discussions. So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's this month, so your last chance! And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis. Your analyst trying hard to avoid that waste of time called twitter / X. By Nadeem Walayat Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | |||||||||||||||